Elon Musk kicked-off 2026 announcing xAI would invest more than $20 billion in a data center in Southaven, Mississippi.

Why Mississippi? "Insane execution speed,” Musk said in the press release.

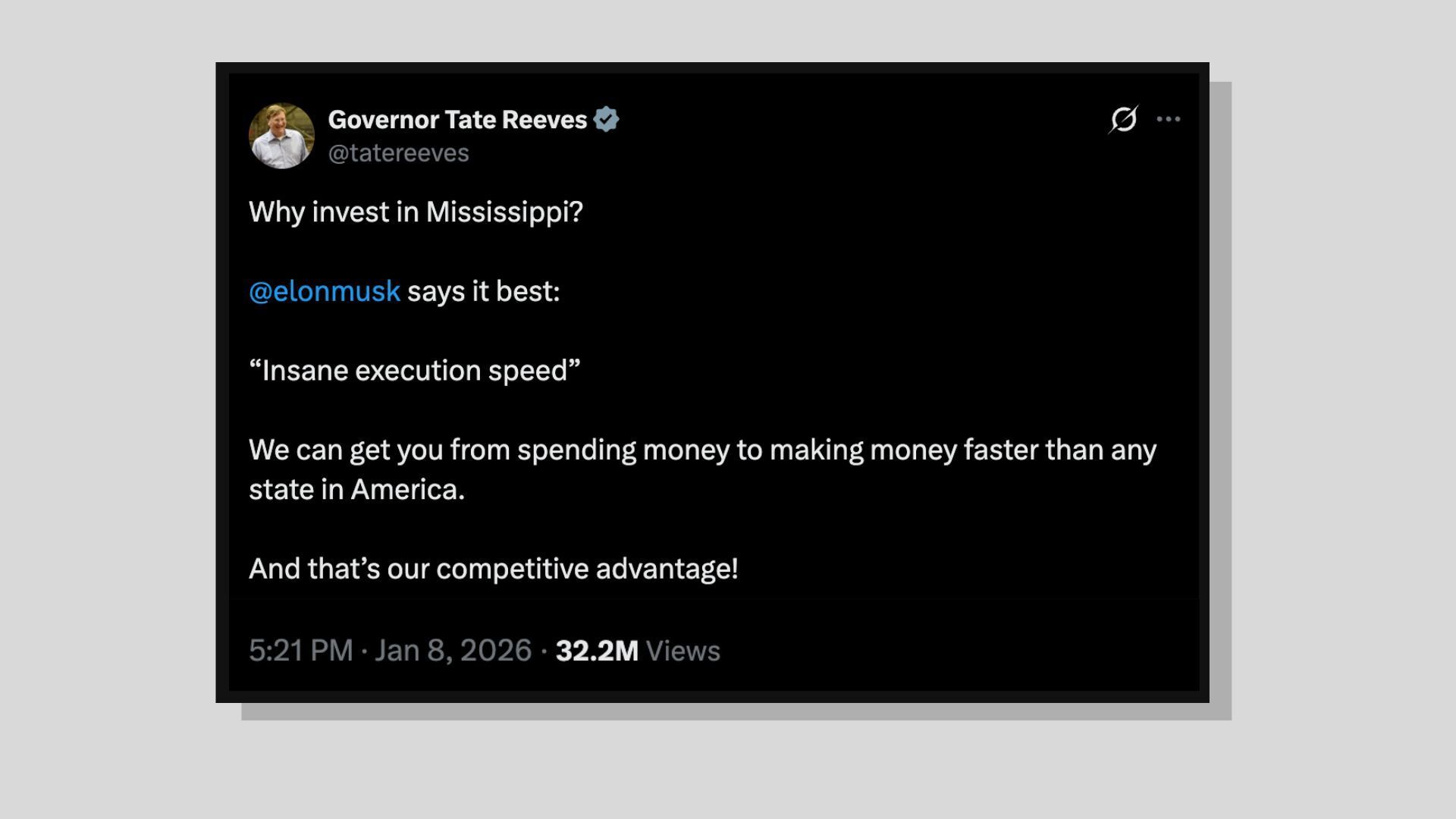

Governor Tate Reeves didn't miss the moment, posting on X:

"We can get you from spending money to making money faster than any state in America. And that's our competitive advantage."

If there's one through-line from every conversation I've had over the past few months – with governors, site selectors, and economic development chiefs – it's this:

Speed has become the currency of competition.

Michelle Comerford of Biggins Lacy Shapiro & Co., and chair of the influential Site Selectors Guild, put it plainly when we sat down to discuss 2026's biggest site selection trends:

"From a company standpoint, it's speed to market and cost – but almost speed to market in first place and cost right behind it. Because time is money. Anything that can help speed up that process on the front end is what a company is looking for right now."

This isn't a new trend, exactly. Site selectors have been preaching site readiness for 15 years.

But the current wave of industrial activity – from the AI infrastructure build-out to reshoring critical industries like pharmaceuticals and defense – has transformed speed from best practice into existential imperative.

The sites that were prepped and ready coming out of COVID got gobbled up. Now everyone's scrambling to catch up.

🏁 Here’s who is setting the pace.

Zach Silber

Editor-in-Chief

Standard & Works

1. ✅ Proof Points

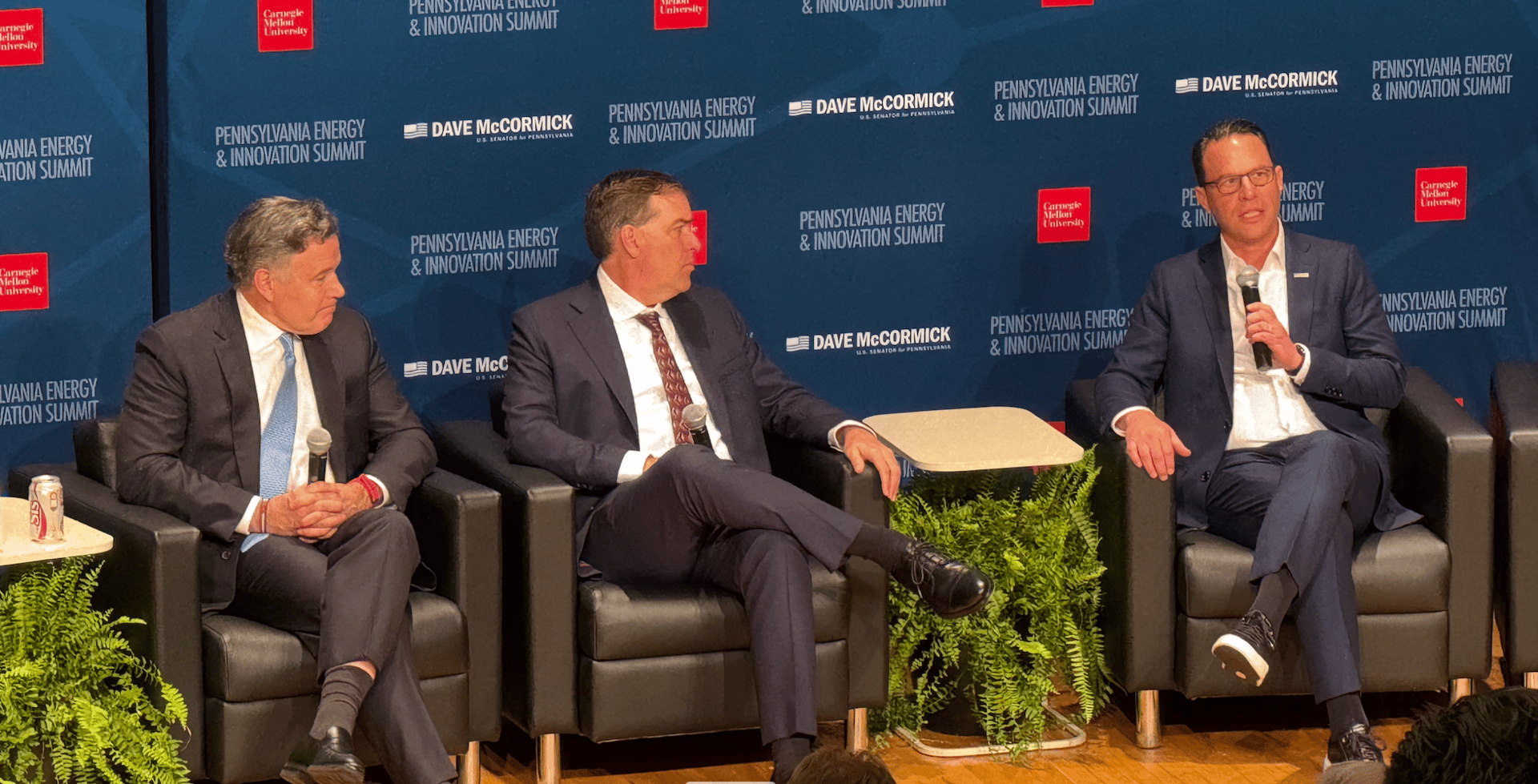

Sen. David McCormick, AWS CEO Matt Garman, and Gov. Josh Shapiro discuss Amazon’s $20B data center investment at the Pennsylvania Energy & Innovation Summit on July 15, 2025 | Photo: Standard & Works

Beyond Mississippi, speed was cited as the critical factor in three of the most significant CapEx deals of 2025:

◼ Amazon Web Services | $20 Billion | Pennsylvania

When AWS evaluated Pennsylvania for its $20 billion data center investment, speed was the differentiator.

"Speed in this race matters more than anything," AWS CEO Matt Garman told a standing-room-only audience of the world’s largest CapEx investors at the Energy Innovation Summit in Pittsburgh last summer.

The Summit’s host, Senator Dave McCormick, a former Bridgewater CEO, framed what executives actually prioritize:

"It's much more about speed and talent than subsidies."

◼ AstraZeneca | $4.5 Billion | Virginia

When AstraZeneca was deciding where to locate a new manufacturing plant, Virginia Governor Glenn Youngkin and his team were in the company's London offices.

Thirty-three days later, AstraZeneca made a $4.5 billion commitment to Virginia – the company’s largest investment ever.

Youngkin told me last month that AstraZeneca's CEO coined a phrase for what Virginia delivered: "The new standard is Virginia speed."

The former co-CEO of Carlyle Group, Youngkin summed up his philosophy on pace: "You have to move at the speed of business, not the speed of government."

◼ Anduril Industries | $1 Billion | Ohio

Founder Palmer Luckey told Bloomberg last January that his company located its major defense manufacturing hub in Ohio because the state had the best shot at hitting an aggressive 18-month production timeline.

"It has to be this fast because we don't have time for business as usual," Luckey said. "The fact that we are predicted to run out of munitions within the first eight days of a potential conflict with China means that we need to hyperscale our manufacturing."

2. 🤝 Bipartisan Consensus

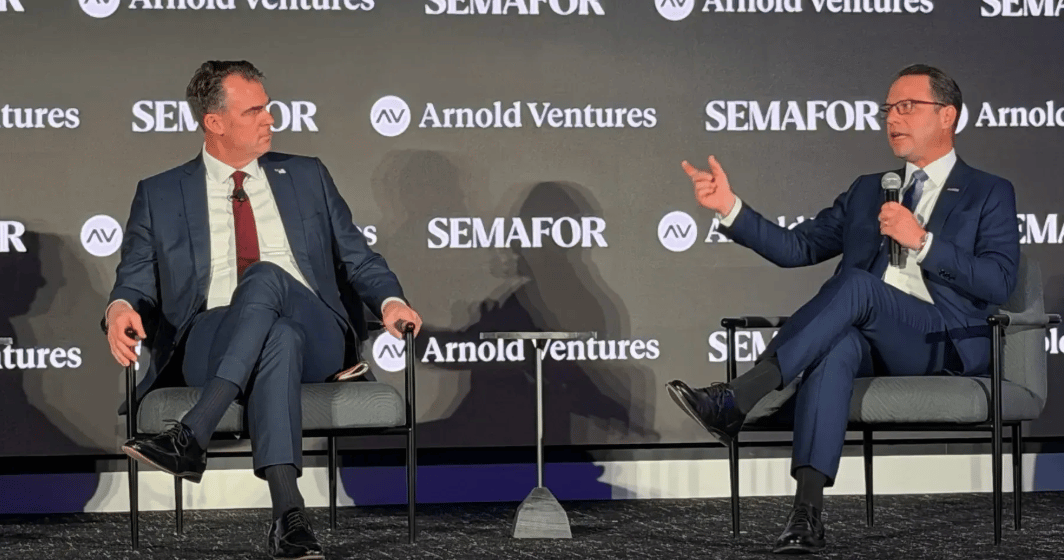

Gov. Kevin Stitt (R-OK) and Gov. Josh Shapiro (D-OK) at a SEMAFOR permitting reform event in Washington, D.C. on December 9, 2025 | Photo: Standard & Works

The speed imperative does not follow partisan lines.

I flew to Washington last month to watch Pennsylvania Gov. Josh Shapiro and Oklahoma Gov. Kevin Stitt discuss permitting reform with SEMAFOR.

The two governors – a Democrat championing natural gas, a Republican championing wind – agreed on the same principle: we need to move faster.

Shapiro’s view: "Our lunch is being eaten by other countries, particularly China, when it comes to speed. We are our own worst enemies."

Stitt shared a stat from a pipeline CEO: permitting now costs twice as much as actually building the project. His solution: a "shot clock" that forces agencies to move or permits are automatically approved and fees are refunded.

3. ⚡ Speed Over Subsidies

Nevada GOED’s executive director Tom Burns talks with Standard & Works editor Zach Silber at CES in Las Vegas on January 8, 2025 | Photo: Standard & Works

Missing from the discourse: talk about traditional levers like incentives or tax breaks.

As Shapiro put it: "Nine times out of ten, CEOs aren't looking for a handout. They want speed and certainty."

Tom Burns, executive director of Nevada Governor Joe Lombardo's Office of Economic Development, was even more explicit:

"If you're looking for the state that writes the biggest check, I'm not likely to be him." Where Nevada wins: "You're going to get to market 90-120-180 days, one year earlier than other marketplaces."

4. 🔍 What Speed Actually Looks Like

Ohio State President Ted Carter during a JobsOhio panel at CES

Comerford walked me through where companies evaluate velocity:

◾ State Permitting

Pennsylvania's turnaround is a model, according to Comerford.

"When Governor Shapiro was elected, he met with a bunch of companies and asked 'what's the biggest problem?'"

“Everyone said: regulations – the approval process is way too long and complicated. So he formed the Office of Transformation and Opportunity to bird dog the process, to help remove barriers and speed it up. We've had experience with that and they've been an excellent partner."

The proof is in new numbers released yesterday by Pennsylvania.

Between 2023 and 2024, DEP permit processing time is down 65%, Labor & Industry processing time is down 89%, Highway Occupancy Permit review time is down 32%.

That's not marketing. That's measurable.

◾ Site Readiness

Has the land had environmental studies? What's under the soil? Any cultural or archaeological issues? Having answers to these questions before a prospect shows up compresses the timeline. Those who don't are competing at a disadvantage.

Kentucky Governor Andy Beshear dedicated $70 million to site readiness in his State of the Commonwealth this month – one of the most significant economic development policies announced so far in this year’s cycle of gubernatorial addresses.

◾ Workforce

Speed isn't just permits. It's having people ready when the plant opens. Comerford noted the skills gap has gotten worse – AI isn't replacing manufacturing workers; it's requiring a higher baseline of skills.

The kind of approach companies are looking for:

Ohio State president Ted Carter, a nuclear engineer and retired Navy Admiral, plans to stand up a nuclear engineering program in just 18 months. OSU will receive backing for the program from nuclear company Oklo and its CEO Jacob DeWitte.

The program will solidify Ohio as one of America’s nuclear hubs while addressing a timely need for nuclear engineers to support Oklo's 1.2 gigawatt nuclear power campus in Southern Ohio, which will power Meta’s data center supercluster in the region.

5. 🚨 Speed Traps

Secretaries Burgum and Wright join Governors Shapiro (PA), Moore (MD), and Youngkin (VA) at the White House on January 16, 2025 | Photo: Department of the Interior

⛔ Power

Power capacity and infrastructure is the chokepoint. A general manufacturing plant needs 50 megawatts. A data center typically needs 250. And utilities are saying: we're tapped out.

That constraint could reshape the competitive map – opening opportunities for regions that weren't previously competitive, if they have the power.

Four strategies are emerging:

⚫ Bring your own: I asked Youngkin how Virginia – the world’s largest data center market – can keep up the momentum as the industry hits headwinds. "Bring your own power" was one of three trends Youngkin said are shaping the next wave of development – alongside water conservation and local decision-making.

⚫ Energy abundance: States are packaging their energy strategies. Utah's Governor Spencer Cox has Operation Gigawatt. Shapiro regularly touts he's an "all of the above" energy governor.

New Jersey Governor Mikie Sherrill, sworn in Tuesday, declared a state of emergency on utility costs as her first act in office – freezing rate hikes and directing agencies to fast-track solar, battery storage, and nuclear generation.

Her day-one message: "More power means lower costs."

⚫ Attack the bureaucracy: Last week, Governors Shapiro, Youngkin, and Maryland's Wes Moore joined Energy Secretary Chris Wright and Interior Secretary Doug Burgum at the White House to announce a bipartisan Statement of Principles demanding reforms at regional grid operator PJM.

All 13 governors in the PJM market signed on. The plan: cap capacity prices, accelerate new generation, and make data centers pay their fair share.

It was the culmination of a months-long pressure campaign against PJM led by Shapiro to demand, where he’s given an ultimatum that Pennsylvania will “go our own way,” if the interconnection process doesn’t accelerate.

⚫ Play the long game: Alaska is betting they can leapfrog peers when the Lower 48 runs out of room. Governor Mike Dunleavy flew to CES this month with a pitch built around energy abundance: 150 volcanoes for geothermal, second largest tides in the world, and a new natural gas pipeline enabling 5 to 7 cents per kilowatt-hour electricity.

"In five years, if you want to build a data farm, I think Alaska is the place you want to look at," Dunleavy told Standard & Works.

⛔ Activism

There's another major speed trap Comerford flagged – one that I know too well, having spent most of my career navigating the geopolitics of site selection for large CapEx projects.

Community opposition has become a significant factor. Data center backlash, in particular, has spread fast and is impacting the political calculus for all types of projects.

"This is something I did not foresee twelve months ago – how big of an issue this would become," Comerford told me. "And I don't see it getting any better in the next twelve months."

My two cents: Smart CapEx investors must factor political risk into their process from day one.

Game it out: With 36 gubernatorial races on the ballot this year and control of Congress in the balance, it's critical to understand scenarios and election year dynamics. You do not want to be at odds with someone a Governor needs an endorsement from.

Fight fire with data: tools like Heatmap Pro, a political risk forecasting platform for data center siting, and GatherGov – a tool that listens to public meetings across the country to identify signals of opposition – are assets in the modern site selection tech stack to help de-risk projects early.

6. 🏁 The Finish Line

Our pick for movie of the year: F*PJM, starring Gov. Josh Shapiro

The playbook for 2026 isn't mysterious: speed to permits, speed to power, speed to workforce, speed to community alignment.

The states winning deals aren't necessarily the ones writing the biggest checks. They're the ones who've figured out how to compress timelines and de-risk execution.

Virginia went from pitch to $4.5 billion announcement in 33 days. Pennsylvania cut permitting times by up to 89%. Oklahoma runs a shot clock on permits. Nevada gets companies into market up to a year faster. Ohio is standing up a nuclear engineering program in 18 months.

It’s the need for speed.

That's the theme of the year.