Fifteen years ago, Sean Farney built and ran data centers for Microsoft – including a 120MW project that clocked in as sixth largest in the world.

Today, the biggest projects are measured in gigawatts, not megawatts.

Now VP of Data Center Strategy at JLL, Farney applies his operational experience to support clients globally across more than 4 GW of active data center capacity.

–––

We spoke with Farney to understand the data center boom’s emerging map, including which regions are positioned for investment and the implications for site selection.

📖 We also drew from JLL’s Midyear North America Data Center Report — a comprehensive pulse of an industry mid-sprint.

Below are five insights about this fast-evolving geography of the AI economy.

Have a great weekend.

Zach Silber

Editor in-Chief, Standard & Works

🎧Our full conversation with Sean Farney drops Monday on The Standard & Works Show. Follow us here.

1. ⚙️“Bonkers” Market Dynamics

Data Source: JLL Research

Asked to sum up the state of the industry, Farney gave one word:

“Bonkers – that's a technical term.”

“ I’ve never seen the space as hot as it is from a pipeline, trajectory, and acceleration standpoint,” Farney told us.

Supply is tight, demand is relentless, and nearly every watt of new capacity is spoken for before the foundation is poured.

“We’re running at 98% utilization,” he says.

Across North America, 8 GW of data centers are under construction, with three-quarters already leased.

Companies looking to expand are often forced to pre-lease and wait a year or more for power to come online.

📊 The Big Picture: JLL expects $1 trillion in new data center development between 2025 and 2030 – adding over 100 GW of capacity.

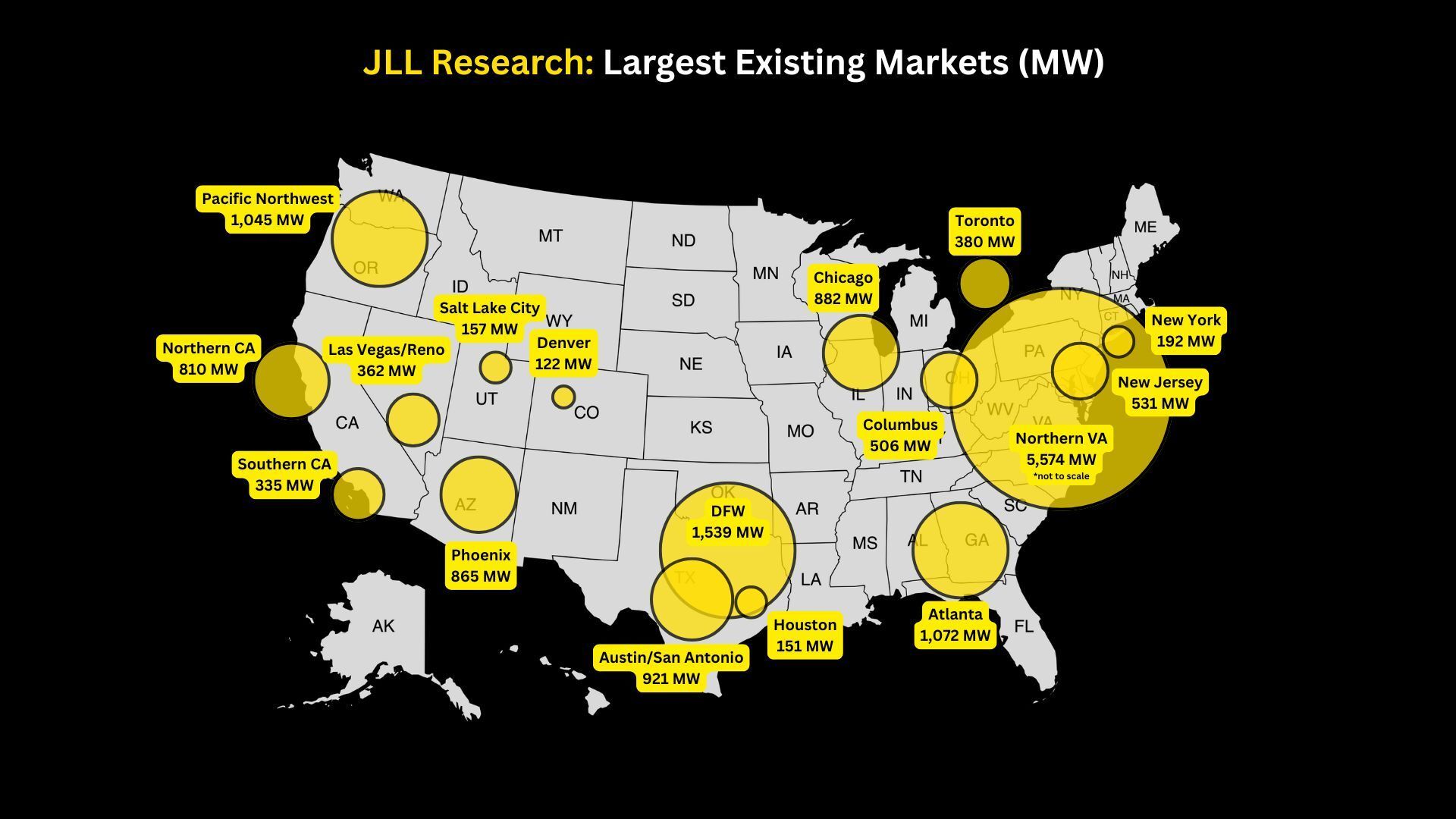

2. 🏆 Northern Virginia Still Reigns — For Now

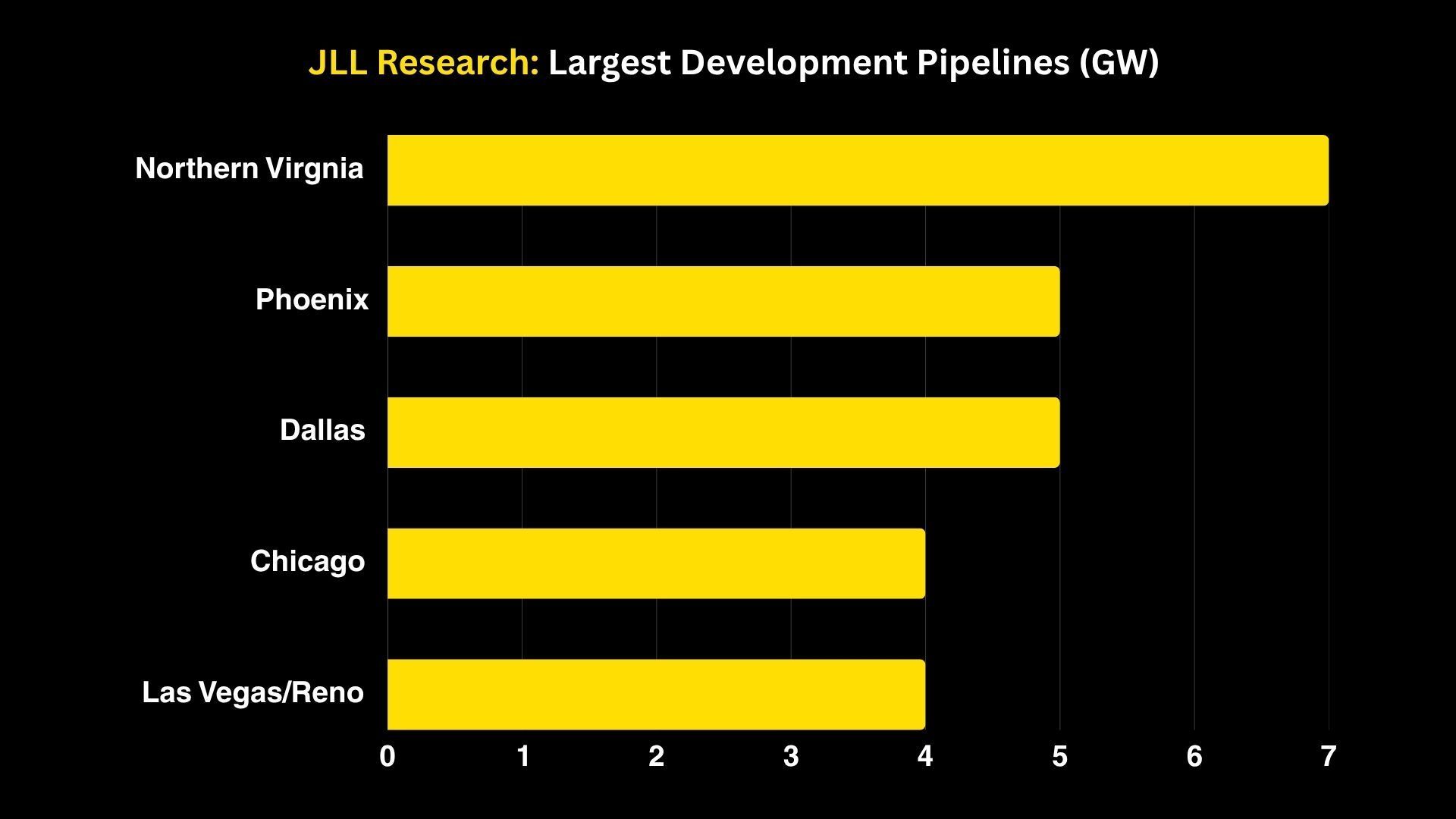

With 5.5 GW of active data centers, Northern Virginia remains the world’s largest data center hub – triple the size of its nearest rival, Dallas-Fort Worth.

The region handles 70% of global internet traffic.

“There’s a bit of a cluster effect with data centers,” Farney explains.

🍔 “Almost like when you see a McDonald’s go up on one corner, across the street a Burger King will go there right away, and then a Wendy’s and so on.”

“The hyperscalers trust each other in the due diligence that’s done.”

But Northern Virginia's power grid is straining.

“Some load is starting to shift,” he says. “We’re seeing movement from Virginia to Atlanta and Columbus.”

Still, the region commands the country’s largest development pipeline – 7 GW of projects are planned or under construction, according to JLL.

👀 What We’re Watching:

Governor Glenn Youngkin has doubled down on keeping Virginia on top.

He recently touted a $9 billion Google investment as an endorsement of Virginia's “leadership in the AI economy”

In May, Youngkin vetoed a bipartisan bill that would have restricted data center development.

Loudoun County’s economic development website proudly brands the region as “Data Center Alley.”

📊 JLL Data: In just the first half of 2025, 50% of all leases (known as absorption) occurred in Northern Virginia and Dallas combined.

3. ⚡The Search for Power and “Digital Dirt”

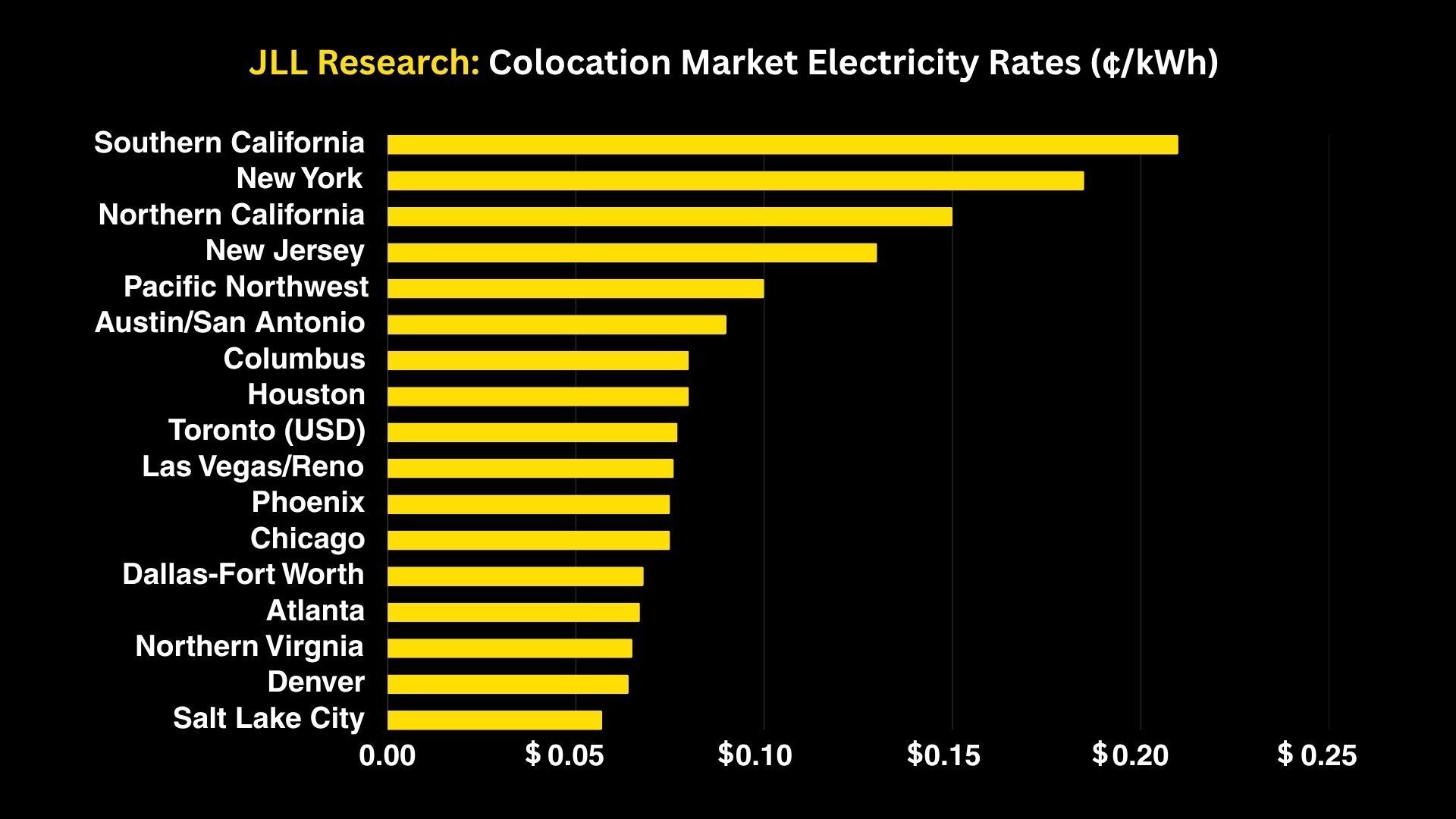

Data Source: JLL Research

If you want to predict the next wave of data center investment, Sean Farney has a simple tip: follow the natural gas.

“The presence of cheap, abundant power — especially natural gas — is shaping where this industry grows next,” he says.

“Twenty-four-inch-plus [natural gas] supply lines drive site selection.”

Power access is forcing site selectors further afield.

The average grid connection delay has stretched to four years, and commercial electricity rates have risen nearly 30% in five years.

This dynamic has driven legislation, like HB 15 in Ohio, which clears the way for large industrial projects to build their own microgrids.

Developments are also getting larger and larger, Farney says.

“As they grow, they need larger chunks of land that have power attached to them — what we call digital dirt.”

A new generation of frontier markets are being fueled by the search for digital dirt:

DeKalb, IL: Meta turned stranded nuclear power into a 500-acre campus.

Quincy, WA: Hydropower priced at two cents per kWh attracted $10 billion in new builds.

Abilene, TX: Oracle and OpenAI’s Stargate project is expanding nearly three hours outside Dallas to tap lower-cost energy.

📊 JLL Data: 75% of development activity is in low-cost electricity markets.

4. 🏭 Rust Belt Revival: The Bit Factory Town

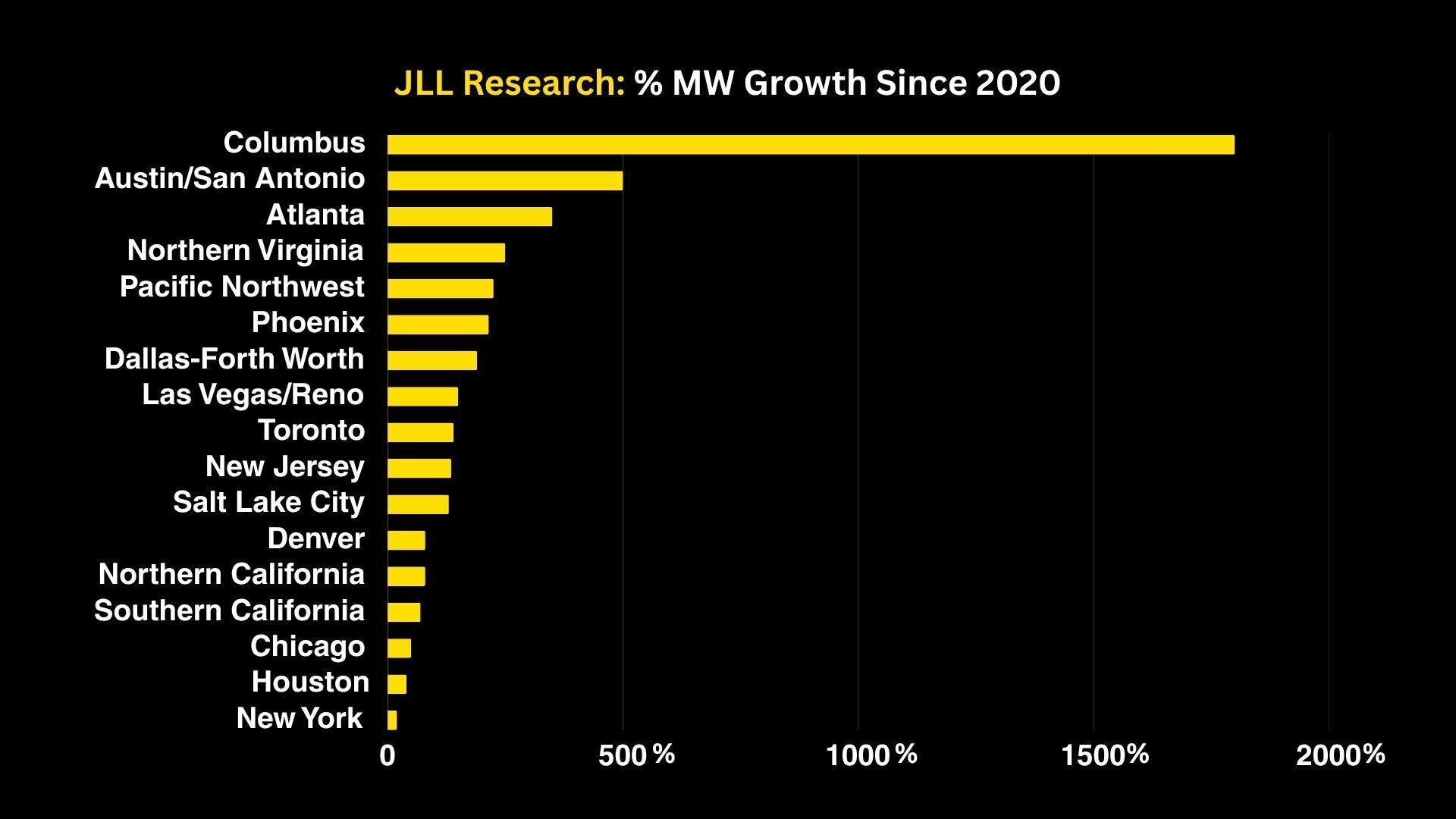

Data Source: JLL Research

The next wave of development could give new life to shuttered industrial towns.

“There's massive opportunity right now,” Farney says. “We’re seeing old steel mills and paper plants around the Great Lakes being converted into data centers.”

Why? They already have the bones — robust structures, transmission lines, and industrial zoning.

“It’s fantastic to see these facilities open back up,” he adds. “It reinvigorates the local economy and provides jobs again. We may see a resurgence of the factory town — but now it’s a bit factory.”

Farney believes this “adaptive reuse” trend could reshape the geography of American industry.

“JLL and other folks that do site selection are scouring the Great Lakes Basin and the Rust Belt for these really good-bones buildings,” Farney says.

📊 JLL Data: Columbus (+1,800%), Austin/San Antonio (+500%), and Atlanta (+350%) have led in growth since 2020.

5. 🧭 How States Compete for Data Center Investment

I asked Farney what Governors can do to attract the next wave of digital infrastructure.

His advice was simple: “Just make it easier to do business.”

He also noted the importance of senior-level engagement and speed.

“Even just the visibility around senior-level execs saying, ‘Hey, we support what you’re doing – how can we help?’ and just allowing these companies to move as fast as they can move and not at the speed of the state.”

Farney points to Governor J.B. Pritzker in Illinois — who has made quantum computing a pillar of the state’s economic development strategy — and Governor Josh Shapiro in Pennsylvania, whose support helped land AWS’s record-setting $20 billion investment.

“This is hopefully the start of a new public private partnership,” he says.

The Standard & Works View

We are at a tipping point between the speed of data center development and the patience of the public.

Our friends at Heatmap News recently reported more than 100 data center projects now face organized opposition.

Standard & Works will soon publish data tracking where opposition is rising fastest — a trend that will increasingly shape site selection decisions and temper the enthusiasm of even the most data-hungry states.

👇 What We’re Watching: Markets with the Largest Development Pipelines

Data Source: JLL Research

🎧 Our full conversation with Sean Farney drops Monday on The Standard & Works Show.